Op-Ed To Vima, Private and public debt: How shall we pay for the pandemic?

Just as after wars, so too after major economic recessions there comes a time to pay off the debt or at least reduce it in relation to GDP through economic development and inflation.

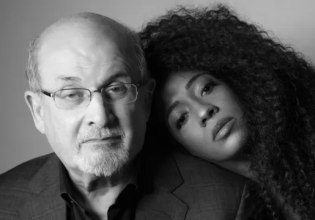

By George Alogoskoufis*

With the Greek economy having been through a period of moderate recovery after 2016 and having shifted its focus toward growth reforms after the 2019 elections, in 2020 it was confronted with a major economic crisis due to the COVID-19 pandemic.

Beyond the public health repercussions, this crisis has led to a significant decline in short-term and middle-term economic prospects.

Greece went through a very deep recession in 2020 and even the most optimistic projections indicate that recovery will come considerably after 2021.

Both the recession and the fiscal cost of managing the crisis will lead to a renewed hike in public debt not only for Greece but the entire world.

In contrast to what occurred in 2010, the crisis finally mobilised the EU to create its Recovery and Resilience Fund, a temporary fiscal mechanism worth 672.5 billion euros.

That will address some of the repercussions of the crisis in the real economy and in the public debt of fiscally vulnerable member-states like Greece.

In 2010 the cost of adjustment was rolled over to member-states, especially those in the eurozone.

Yet the problem remains. How shall we pay for the pandemic? It is the same question, though with different dimensions, posed by Keynes in 1939 – “How shall we pay for the war?”

Certainly, an increase in public borrowing to prop up the economy is the appropriate short-term solution but it entails kicking the can down the road. Just as after wars, so too after major economic recessions there comes a time to pay off the debt or at least reduce it in relation to GDP through economic development and inflation.

Greece experienced austerity mainly between 2010-2018. The global recession of 2008-2009 led to a hike in debt. Austerity imposed between 2010-2018 led to a dramatic decline in GDP, higher unemployment, and greater social inequalities.

Due to the great, protracted recession that resulted, debt as a percentage of GDP grew even further. From 103 percent of GDP in 2007, before the global recession, and from 127 percent of GDP in 2009, in 2018, after the bailout adjustment and austerity programmes, it had jumped to 186 percent of GDP.

Despite the huge cost shouldered by workers, pensioners, and the unemployed, the results as regards public debt were disappointing.

Greece experienced the second solution, the restructuring and partial write-down of the debt in 2012. Despite problems, the results were somewhat improved. Those who paid the piper were mainly the owners of Greek bonds and banks’ stockholders, who were presumptively wealthier than low income salaried workers, pensioners, and the unemployed.

Moreover, there was a temporary halt of the upward trend in debt and the cost of servicing it was reduced.

It is doubtful that something like that can happen again under current conditions.

The debt problem in today’s crisis is global and does not concern only Greece or small economies on the margins of the eurozone.

It is doubtful that the wealthy economies will risk losing their credibility with today’s and future investors through a restructuring or write-down of debt. Nor will economies at the core of the eurozone agree once again to pay part of the cost of restructuring the debt of peripheral economies such as Greece.

That brings us to the third solution of moderate adjustment, which was how the US, British, and other European economies’ public debt was reduced as a percentage of GDP after WWII.

That is how Greece stabilised its public debt as a percentage of GDP between 1994-2007.

Yet that solution entails an important precondition. For a long time the nominal interest rate on government bonds must be lower than the sum of the rate of growth of GDP and inflation

In the post-war era, that was achieved internationally through rapid economic growth and so-called financial repression, which entailed controlled stock markets and limits on the movement of capital so as to keep interest rates low.

In the Greek case, between 1994-2007 that was achieved by lowering interest rates and through the recovery caused by the prospect of admission to the eurozone and then by the beneficial effects of admission.

Can this be achieved today for a long period of time in an era of freed up stock markets and the free movement of capital?

If it could, a large part of the cost would be shifted to presumptively wealthier investors and to future generations, which will have benefited from the economic growth in the interim.

However, a policy of interventions in the operation of stock markets may be necessary. That solution, however, poses the danger that economies will remain vulnerable if a new financial crisis arises.

These are the three choices we have before us. In practice, we may have to use all three in part. None of them is painless and each has different repercussions from redistribution.

In any event, it is important for the government not to lose track due to the crisis of the reform and growth policies on the basis of which it was elected.

A dynamic and sustainable recovery after the crisis will to a large degree help manage the debt problem.

Yet it is equally important for all of the country’s political forces to contribute as much as possible to promoting immediate support measures for the economy in the midst of the crisis and later to contribute to the medium-term reforms that are needed to achieve a dynamic recovery of the Greek economy.

Yorgos Alogoskoufis is professor of economics and chairman of the Faculty of Economics of the Economic University of Athens and is a former minister of economy and economics.

- Γουατεμάλα: 9ος αστυνομικός νεκρός από τα πυρά συμμοριών

- Ιράν: Η Lufthansa αναστέλλει τις πτήσεις προς και από την Τεχεράνη μέχρι και τις 29 Μαρτίου

- Τουλάχιστον 1.500 μέλη του Ισλαμικού Κράτους δραπέτευσαν από φυλακές της Συρίας

- Τρίπολη – Νεστάνη: Νεκρός εντοπίστηκε ηλικιωμένος κατά την κατάσβεση πυρκαγιάς σε κατοικία

- Στα «ΝΕΑ» της Τρίτης: Τρεις ανατροπές υπέρ των παιδιών

- Η Μολδαβία αποχώρησε από την ευρασιατική ομάδα ΚΑΚ της οποία ηγείται η Ρωσία

- Η Premier League αποθέωσε τον Κωστούλα για το καταπληκτικό γκολ (vid)

- Κίνα: Η κίνηση που επαναπροσδιορίζει τον τρόπο που θα διεξάγονται οι μελλοντικές συγκρούσεις

Ακολουθήστε το in.gr στο Google News και μάθετε πρώτοι όλες τις ειδήσεις

![Άκρως Ζωδιακό: Τα Do’s και Don’ts στα ζώδια σήμερα [Τρίτη 20.01.2026]](https://www.in.gr/wp-content/uploads/2026/01/danie-franco-wEuWV0Vz9uw-unsplash-315x220.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232442

Αριθμός Πιστοποίησης Μ.Η.Τ.232442