ESM’s Regling: Majority stake held by institutional creditors in Greece’s debt means stability, low servicing costs

He also noted that Greece posted significant progress in 2019, with the subsequent pandemic devastating all European countries, an unprecedented economic crisis, as he said, but quite different from the one that plagued the EU the previous decade

European Stability Mechanism (ESM) Managing Director Klaus Regling, amongst the “old hands” of the past decade’s Greek bailout memorandums, on Friday emphasized that the fact the EU’s emergency fund holds 55 percent of Greece’s debt is a substantial benefit for the country’s economy.

Regling, who is also the CEO of the European Financial Stability Facility (EFSF), said no other country in the world has such a high percentage of its debt held by institutional creditors, in this case other EU partners, Euro-zone members’ central banks and the ECB, which translates into stability and a low cost of servicing the debt.

“…which will be low for many years to come,” he added.

Regling spoke at the 6th Delphi Economic Forum in Athens, which is taking place in the Greek capital this week as a “hybrid” event, instead of its usual venue, Delphi, the archaeological site in mountainous south-central Greece that was considered the “navel” of the ancient world.

He also noted that Greece posted significant progress in 2019, with the subsequent pandemic devastating all European countries, an unprecedented economic crisis, as he said, but quite different from the one that plagued the EU the previous decade.

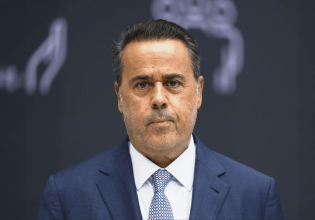

Regling was joined by his chief interlocutor from the Greek Cabinet, Finance Minister Christos Staikouras, who said the center-right government’s intent to implement reforms is continuing without delays.

In looking past the pandemic and its repercussions, Staikouras pointed to an increase in Greece’s industrial output by 5 percent on a yearly basis, a stable employment level due to financial supports funnelled by the state to businesses and self-employed professionals, higher consumer confidence and a reduction in NPLs held by systemic banks by 30 percent on an annual basis. Staikouras also appeared satisfied with Greece’s recent high-profile forays into the markets for its sovereign borrowing.

- Γουατεμάλα: Σε «κατάσταση πολιορκίας» κηρύχθηκε η χώρα μετά τις δολοφονίες αστυνομικών από συμμορίες

- Πορτογαλία: Ο ακροδεξιός υποψήφιος περνάει στον δεύτερο γύρο των προεδρικών εκλογών

- Γουατεμάλα: 7 αστυνομικοί δολοφονούνται από συμμορίες μετά τις εξεγέρσεις σε φυλακές

- Συναγερμός για μεγάλη πυρκαγιά σε εργοστάσιο στις Αχαρνές

- Γροιλανδία: ΕΕ και Βρετανία δεσμεύονται για την κυριαρχία της Δανίας, λέει η Ούρσουλα φον ντερ Λάιεν

- Στα «ΝΕΑ» της Δευτέρας: Ελαφρύτερα εκκαθαριστικά