How Goldman Sachs views Greek banks

New price targets and investment recommendations

Greek banks continued to show progress in optimizing NPEs, capital formation and capital buffers in the first quarter of 2022, delivering better than expected results, according to a report from Goldman Sachs, which also predicted that the strong trends will continue in Q2 2022.

The authors of the report point out that the degree of macroeconomic uncertainty has increased over the past three months: Greek inflation accelerated to 12% in June 2022 while mean GDP projections fell to 3%.

The 10-year Greek government bond yield reacted to these macroeconomic developments, rising to around 3.5%-4% in July 22, while in 2021 it averaged around 1%.

The impact

The US bank also says that its commodity analysts recently revised their natural gas price forecasts (TTF) to reflect a weighted scenario regarding Nord Stream 1 flows after the completion of maintenance projects – specifically, they raised forecasts for Q1 2022/Q4 2022/Q1 2023/Summer 2023 to 153/121/77/138 euros/MWh respectively from 104/105/76/75 euros previously.

Goldman Sachs in its report analyzes the impact of accelerating inflation, an aggressive interest rate environment and increases in natural gas prices on Greek banks. While pointing to strong bank-specific trends in Greece, increased macroeconomic uncertainty translates into more conservative cost of equity (COE) assumptions (mainly resulting from a 300bp discount on Greek 10-year bond yields to 2021) and to lower estimates (on average lowering EPS estimates by 9% in 2023-24, reflecting the effects of higher inflation and commodity prices).

Investment recommendations and target – prices

National Bank

Goldman Sachs restores a buy recommendation on the stock with a 12-month price target of €3.95 (up 33% from the July 13 close). Goldman lauds the progress made by National’s management in consolidating NPEs, creating reserve provisions, recovering ROTE and restoring capital buffers over the past three years. “We see the National Bank as relatively well positioned in the current uncertain macroeconomic environment, thanks to a ‘defensive’ combination of a relatively high CET1 ratio and a higher NPE coverage ratio,” the bank noted.

Eurobank

The bank reset the recommendation to neutral from buy, adding that it still expects Eurobank to have the highest ROTE within the coverage of Greek banks and to be one of the first Greek banks to reach average European levels in CET1/NPE ratios. In their analysis, Eurobank is relatively well positioned in the current uncertain macroeconomic environment, thanks to the combination of a relatively high CET1 ratio, an NPE coverage ratio of 82 and strong organic capital generation.

While they acknowledge Eurobank’s strong progress on key operational metrics, they note that Eurobank already trades at the highest valuation multiples within its coverage of Greek banks. The revised 12-month ROTE/COE price target is €0.92 (from €1.50).

Alpha

Goldman Sachs maintains its buy recommendation. According to the analysts, Alpha offers the best risk-reward profile in the coverage of Greek banks. The revised share price target based on ROTE/COE is €1.07 (from €1.74).

Piraeus Bank

Goldman Sachs is maintaining the consistency at neutral. It positively assesses the progress made by the Piraeus bank’s management in reducing the NPE balance, creating reserve provisions, recovering ROTE and restoring capital buffers. The new target price is at 0.84 euros, from 1.80 euros.

- Οι δυνάμεις ασφαλείας στην Αϊτή διεξάγουν εκστρατεία κατά των συμμοριών και καταστρέφουν κρησφύγετα

- Ο Τραμπ θέλει 1 δισ. δολάρια από κάθε κράτος για να γίνει μέλος στο Συμβούλιο Ειρήνης

- Γιατί ο Τραμπ στρέφεται κατά της JP Morgan;

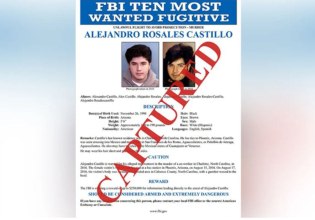

- Καταζητούμενος από το Top 10 του FBI συνελήφθη στο Μεξικό

- Οι ΗΠΑ σκότωσαν «ηγέτη συνδεόμενο με την Αλ Κάιντα» στη Συρία

- Κατάσχεση – «μαμούθ» στον Παναμά με περισσότερους από 5 τόνους να πέφτουν στα χέρια των αρχών

- Χάος στη Γουατεμάλα – Μέλη συμμορίας κρατούν ομήρους 46 φρουρούς σε 3 φυλακές [βίντεο]

- Συρία: Ο στρατός πήρε τον έλεγχο στρατιωτικού αεροδρομίου, φράγματος και πετρελαιοπηγών

Ακολουθήστε το in.gr στο Google News και μάθετε πρώτοι όλες τις ειδήσεις

![Άκρως Ζωδιακό: Τα Do’s και Don’ts στα ζώδια σήμερα [Κυριακή 18.01.2026]](https://www.in.gr/wp-content/uploads/2026/01/spenser-sembrat-i607NbWkXow-unsplash-315x220.jpg)

![Χάος στη Γουατεμάλα – Μέλη συμμορίας κρατούν ομήρους 46 φρουρούς σε 3 φυλακές [βίντεο]](https://www.in.gr/wp-content/uploads/2026/01/guatemala-prison-315x220.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232442

Αριθμός Πιστοποίησης Μ.Η.Τ.232442