Retail: The fragile balances of supermarket groups and the dance of deals

What is happening in the ELOMAS and Asteras groups – What will change through the imminent acquisition of the Collaborating Grocers group by ANEDIK Kritikos

In a period of intense restructuring for all small and medium-sized entrepreneurs in the supermarket sector, the bet of survival for retail cooperatives seems to be fraught.

The unraveling of the collaborations within the Hellenic Group of Supermarket Chains (ELOMAS) after the shocking departures, first of the chains ANEDIK Kritikos and Bazaar and then of the Consumer Cooperative Chania SYNKA, following its partnership with Masoutis, seems to not have come to an end.

The most powerful shopping group, which in fact a few months ago decided to delete one of its member companies, is losing another… “big gun” since the Cooperating Grocers supermarket group is heading towards the fold of ANEDIK Kritikos.

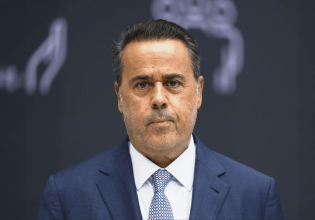

The deal for the acquisition Cooperating Grocers supermarket group of Yiannis Pilidis by Kritikos owned by Angelos, Nektarios and Dimitris Kritikos has been finalized as reported by Mr. Pilidis to OT. However, the final documents have not been inked yet, but will be soon, he notes.

Turnover of 100 million euros

The agreement, if concluded successfully, concerns the acquisition of 52 privately-owned stores of the Collaborating Grocers group, as well as the management of the Helios, Proodos and Hellenic Market brands, which operate under the franchise regime, with more than 360 stores.

The turnover of the Collaborating Grocers group in 2021 closed at 95 million euros, while for this year the turnover will approach 100 million euros.

The deal, according to Mr. Pilidis, is estimated to be completed by November 15.

As for how he decided to sell, the experienced retailer’s answer is clear: “After 41 years of work, the time has come for me to enjoy the fruits of my labor.” However, he did not want to reveal the price.

ELOMAS management

At the same time, however, in the new Elomas Management Committee, which was unanimously elected at the group’s recent general meeting (July 13, 2022), along with Christos Gountsidis (Gountsidis SA), Charalambos Andrikopoulos (Andrikopoulos SA), Konstantinos Panagiotopoulos (Bros. Panagiotopoulos SA ), Evangelos Gegos (Gegos S.A.) and Evangelos Koutelieris (Koutelieris S.A.), Yannis Pilidis also participates.

The members of the ELOMAS Management Committee jointly represent and bind ELOMAS with their signature, effectively exercising the administration of the purchasing group.

Losses

The withdrawal of ANEDIK Kritikos and Bazaar cost the turnover of ELOMAS 580 million euros (390 million euros from the turnover of Kritikos and another 190 million euros from the turnover of Bazaar based on the figures of 2020 balance sheets), while in addition 20.7 million euros (2020 balance sheet) were the “lost” sales from the loss of the Pieria supermarket chain. Also, the 231 million euros that “leave” due to the withdrawal of SYNKA, as well as the 100 million euros of the Cooperating Grocers group, should be factored in, when and if the deal with Kritikos is completed.

All this restructuring results in a significant reduction in the cumulative turnover of ELOMAS (it was 1.2 billion euros in 2020).

In the meantime, however, some chain transfers were made from other shopping groups in order to maintain the group’s bargaining advantage and offset the loss.

It is worth mentioning that 10 years ago ELOMAS had an annual turnover of 1.8 billion euros, which over time and the restructuring processes of the sector declined significantly.

Since the 90s

ELOMAS was founded in 1994 following the initiative of the then Deputy Minister of National Economy, Nikos Skoulas, Minister of Tourism and for two terms Secretary General of EOT, who was also the first to envision the creation of a purely Greek retail trade group.

The five founding members of the ELOMAS network were the companies: Galaxias – Dimitra Market, Galinos Lautaris, Ountsidis, Biskas and INKA Chania (now SYNKA).

Officially, more than 25 small and medium chains were under its “umbrella”.

The Asteras – Spar project

Faced with new challenges is the Asteras supermarket group, which cooperates with the international cooperative brand Spar during its second round in Greece, under new managers.

So far, however, the five-year goals that Spar International had set with the return of the brand to Greece in 2018, have not been achieved in the slightest.

Spar’s original plan for Greece had set the bar for 2021 at 330 stores for the network and at 519 million euros for turnover.

Today, the Asteras supermarket group has 78 members, several of which have more than one point of sales throughout Greece, with a total of 170 points of sale nationwide.

At the same time the ELETA group (Proton stores) has 350 members who in total have around 450 points of sale.

Weak spots

With the main objective of shielding small and medium-sized retail businesses against the large chains and foreign competition, but at the same time supporting Greek production and Greek consumers, shopping groups began to grow from the beginning of the 1990s.

Contrary to the operating patterns of corresponding groups abroad, the evolution of domestic cooperative schemes shows that they tend to exhaust their limits and especially in this difficult moment when energy costs are eating into the profits of their members.

According to market analysts, their weak points are found in the relationship with suppliers, in the services provided to their members, in adapting to new market trends, but also in their internal cohesion.

After all, the “merry go round” phenomenon is well known, with businesses going from one supplier cooperative to another and back again.

- ΔΟΑΕ: Ολοκληρώθηκαν οι εργασίες επανασύνδεσης του πυρηνικού σταθμού με το δίκτυο ηλεκτροδότησης στη Ζαπορίζια

- Super League: Η βαθμολογία μετά την 17η αγωνιστική (pic)

- Βόλος – Ατρόμητος 0-3: Ανάσα για τους Περιστεριώτες στο Πανθεσσαλικό

- LIVE: Μπράιτον – Μπόρνμουθ

- Έτος καταστροφής το 2025 για τα κρυπτονομίσματα

- «Κατηγορώ τον Ντόναλντ Τραμπ»: Στο νοσοκομείο ο Πιρς Μόργκαν μετά από πτώση – Υποβλήθηκε σε αντικατάσταση ισχίου