Alpha Bank: Deal with UniCredit – What the agreement provides

What does the agreement between the two banks in Romania and Greece provide for?

Alpha Bank and UniCredit entered into a multi-layered surprise deal, marking the first major investment by a foreign bank in Greece in many years. The agreement is based on two parts, the merger of their subsidiaries in Romania and the achievement of strategic cooperation in Greece, focusing on the acquisition of the 9% held by the HFSF in Alpha Bank from the Italian bank.

Following this, the Securities and Exchange Commission suspended trading of Alpha Bank‘s stock until more information is available on the multi-level deal.

In particular, the two banks announced:

Merger of the two banks’ subsidiaries in Romania and create the 3rd largest bank in the Romanian banking market based on total assets, strengthening UniCredit’s presence in a major and growing market. Alpha Bank maintains a 9.9% stake in the new structure.

Formation of a framework for a commercial agreement in Greece for the distribution of portfolio management and life insurance products, linked to units of mutual funds (unit linked) of UniCredit, to the 3.5 million Customers of Alpha Bank, and creation of a joint scheme for the sale of pensions and insurance products, through the acquisition of 51% of AlphaLife by UniCredit.

Submission of an offer by UniCredit to the Financial Stability Fund for all the shares it currently holds in Alpha Services and Holding

Financial Stability Fund picks up the baton

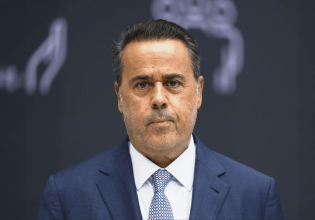

“The Government welcomes UniCredit’s decision to invest in Alpha Bank” said in a statement the Minister of National Economy and Finance, Kostis Hatzidakis, commenting on the mega deal announced today by Alpha Bank.

The Minister of Finance emphasizes that the baton is now being passed to the Financial Stability Fund, which will proceed based on its statute and the relevant procedures provided for.

“However, the fact that a major European bank is investing in the Greek banking system after many years is proof that both the Greek banking sector and the Greek economy have entered a path of perspective and growth. This positive development is the result of systematic work which the Government is determined to continue”, concludes the relevant announcement.

Stability Fund comments

For its part, the Financial Stability Fund welcomes and applauds the strategic agreement between Alpha Bank and Unicredit.

According to the announcement, the receipt of an offer from Unicredit for the purchase of all the shares held by the HFSF in Alpha Bank is confirmed.

In this context, the HFSF will examine, together with its financial advisors appointed in accordance with the HFSF law, this offer in the context of the Strategic Divestment, which (offer) is considered a private sale and involves a competitive process.

“Congratulations to both banks”

“The Bank of Greece welcomes the agreement between UniCredit and Alpha Bank, the first major strategic agreement between a major European bank and a systemic Greek bank, since the financial crisis of the previous decade,” Bank of Greece governor Giannis Stournaras said in a statement.

The head of the Bank of Greece underlines that “this agreement reflects the increased reliability of the Greek economy in recent years, as this has been certified by four rating agencies so far, which have granted investment grade to Greek government bonds. It also reflects the significant progress achieved in the Greek financial system.”

“The two banks, UniCredit and Alpha Bank, are to be congratulated for the systematic work they did to reach this important agreement, which does not only concern Greece and Italy, but the entire Eurozone,” the announcement concludes.

Leader on the Romanian market

As reported, with the merger of the two banks’ subsidiaries in Romania, the 3rd largest bank in the Romanian banking market is created

on a total asset basis, strengthening UniCredit’s presence in a major and growing market. In the new structure, Alpha Bank maintains a percentage of 9.9%.

The merger is a milestone for the local market, due to the combination of two complementary clienteles in a high-growth country, with UniCredit Romania

and Alpha Bank Romania to have a strong presence in the business and retail banking sectors, respectively.

Completion of the transaction is expected in 2024, subject to the prior completion of the due diligence process, the taking of the relevant corporate decisions on the merger as well as all required regulatory approvals and consents, including the approval of the Competition Commission.

Upon completion of the transaction, Alpha Bank is expected to (i) retain 9.9% of the stock capital in the new entity and (ii) receive a cash consideration of

300 million euros. The final amount of the price is subject to adjustments based on the findings of the due diligence audit, related to the quality of the

assets, if any.

- Θεσσαλονίκη: Φορτηγάκι παρέσυρε πεζό

- Ποια λάδια μπορούμε να προσθέσουμε στο μπολ του σκύλου μας – Πότε είναι ωφέλιμα και πότε όχι

- Ακρίβεια: Το 80% των πολιτών έχει αλλάξει τον οικογενειακό του προϋπολογισμό

- «Ψήνεται» νέα ταινία με θέμα τη Μάντσεστερ Γιουνάιτεντ!

- Μελίνα Ασλανίδου: Γιατί ακυρώνει τις προγραμματισμένες εμφανίσεις της

- Γροιλανδία: Ο Ρούτε του ΝΑΤΟ λέει ότι συζήτησε με τον Τραμπ τρόπους για να «παραμείνει ασφαλής η Αρκτική»

- Κίνηση: Χάος στους δρόμους – Στο «κόκκινο» ο Κηφισός, πού αλλού υπάρχουν προβλήματα

- UBS Sees Greek Banks as Undervalued, Raises Price Targets

Ακολουθήστε το in.gr στο Google News και μάθετε πρώτοι όλες τις ειδήσεις

![Άκρως Ζωδιακό: Τα Do’s και Don’ts στα ζώδια σήμερα [Πέμπτη 22.01.2026]](https://www.in.gr/wp-content/uploads/2026/01/josh-gordon-h8Od9ze-0o-unsplash-315x220.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232442

Αριθμός Πιστοποίησης Μ.Η.Τ.232442