Operation ‘Paper Dragon’ Uncovers Major Retail Tax Evasion Scam

Unrecognizable QR codes on receipts given to customers for their purchases led to initial complaints and subsequent Operation Paper Dragon

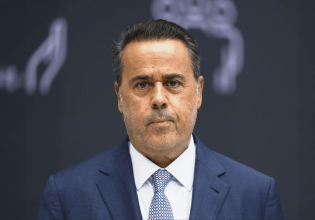

Greece’s tax bureau on Thursday announced that it has “netted” no less than 287 Chinese-owned retail businesses – mostly apparel and footwear – involved in systemic tax evasion, part of an investigation code-named operation “Paper Dragon”. Results of the investigation were presented by Giorgos Pitsilis, the head of the Independent Authority for Public Revenue (AADE or IAPR), as the tax bureau is official called, indicative of its seriousness.

Pitsilis described a complex and inter-locking network of entrepreneurs, accountants and even an IT company involved in tax evasion and avoidance. He said tax auditors were first notified by anonymous complaints against a business based in the northeast city of Komotini, another in the central city of Larissa and a third with a branch in Thessaloniki.

According to reports, it was unrecognizable QR codes on cash register receipts given to customers for their purchases that generated the first complaints.

A further investigation revealed that a local software company with a Greek national as its legal representative was involved with all 287 audited businesses, along with two Chinese nationals residing in Slovakia. The latter two are charged with providing technical expertise to shop-owners in order to rig their cash registers.

Some of the 287 businesses scrutinized by the tax bureau’s in operation Paper Dragon have another 10 to 15 outlets around Greece, leading authorities to calculate millions of euros in uncollected VAT remittances and corporate taxes.

AADE debuted a new app last January to combat tax evasion and VAT avoidance. Specifically, users can download the app to check whether the receipts they are given are genuine or fake.

The app, called “Appodixi” enable consumers to file complaints with their own personal data or anonymously.

The Appodixi application is accessible via mobile phone, and more than 250,000 users downloaded it in the weeks after its debut.

Dependent upon on AADE’s algorithms, complaints are prioritized and automatically channelled to tax authorities for further investigation.

Source: tovima.com

- Η «ανάπτυξη» του Κυριάκου Μητσοτάκη δεν μπορεί να συγκαλύψει τον πραγματικό οικονομικό και κοινωνικό μαρασμό της χώρας

- Επιστροφή στην ευρωπαϊκή «δράση» για Παναθηναϊκό και ΠΑΟΚ

- Ήθελα να του ρίξω γροθιά στο πρόσωπο: Η περίεργη χημεία των Μάθιου ΜακΚόναχι και Γούντι Χάρελσον στο True Detective

- Super Technologies: Μια επένδυση-σταθμός που αλλάζει τον χάρτη του iGaming στην Ελλάδα

- Ιδεολογία και πραγματικότητα στην εξωτερική πολιτική του Ντόναλντ Τραμπ

- Σχολεία: Πού θα παραμείνουν κλειστά και πού θα λειτουργήσουν μια ώρα αργότερα

- Αττική: Στου Παπάγου το μεγαλύτερο ύψος βροχής – Χάρτης με την κατανομή ανά περιοχή

- Τριαντάφυλλος: Τι τον οδήγησε στο νοσοκομείο

Ακολουθήστε το in.gr στο Google News και μάθετε πρώτοι όλες τις ειδήσεις

![Άκρως Ζωδιακό: Τα Do’s και Don’ts στα ζώδια σήμερα [Πέμπτη 22.01.2026]](https://www.in.gr/wp-content/uploads/2026/01/josh-gordon-h8Od9ze-0o-unsplash-315x220.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232442

Αριθμός Πιστοποίησης Μ.Η.Τ.232442