Greece’s Economy Awaits Moody’s Upgrade Rating

At present, Moody’s rates Greece at Ba1, one notch below investment grade, with a stable outlook for reassessment.

Greece’s economy is set to be evaluated by international rating agencies, this coming September. Moody’s assessment is particularly anticipated with interest, as it is the only major agency that still hasn’t granted Greece an investment-grade rating.

The new evaluation process begins with DBRS assessment on Sept. 6, with Moody’s evaluation on the 13th of the same month, Standard & Poor’s on Oct. 18, Fitch on Nov, 22, and Scope Ratings on Dec 6, 2024.

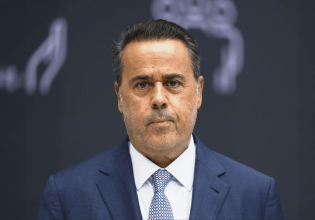

Colin Ellis Moody’s Chief Credit Officer recently hinted at the possibility of an upgrade to investment grade for Greece during an Economist conference. However, Ellis did not provide any commitments or details regarding any specific action by the agency for Sept.

Despite Moody’s being the only significant rating agency that has not yet assigned Greece an investment-grade rating, a lot of analysts think the possible acquisition of the upgrade may not be of such importance as the investing community already views Greek assets as investment-grade.

Nonetheless, those who view Moody’s assessment this Sept. 13 as critical argue that the agency’s global prominence could lead to significant demand for Greek bonds, potentially reaching up to 20 billion euros in case of an upgrade.

At present, Moody’s rates Greece at Ba1, one notch below investment grade, with a stable outlook for reassessment.

In early Aug. 2023, the first significant step toward Greece’s potential upgrade to investment grade occurred when the German agency Scope Ratings, assigned an investment-grade rating to Greece.

This was followed by DBRS in Sept. 2023, Standard & Poor’s in Oct., and Fitch Ratings in Dec. of the same year, resulting in a credit rating of BBB-.

Source: tovima.com

- Φερεντσβάρος – Παναθηναϊκός: Οι χαμένες ευκαιρίες του Πελίστρι! (vid)

- Ρωσία: Στη Μόσχα οι Αμερικανοί διαπραγματευτές Γουίτκοφ και Κούσνερ για συνομιλίες με τον Πούτιν

- Θεσσαλονίκη: Ταυτοποιήθηκαν τα στοιχεία άλλων 10 μελών εγκληματικής οργάνωσης που έκλεβε αυτοκίνητα και τα πουλούσε

- Ζίβκοβιτς: «Δώσαμε τα πάντα και κερδίσαμε»

- Αυστρία: Σε εξέλιξη η δίκη του αξιωματικού των μυστικών υπηρεσιών που κατηγορείται για ρωσική κατασκοπεία

- Βέλγιο: Έξι τραυματίες στην Αμβέρσα σε επίθεση με μαχαίρι – Οι δύο σε κρίσιμη κατάσταση