Greek Government Targets Record Investment Program and Tax Relief for Middle Class

The digitalization of transactions and measures introduced by the Ministry of Finance, such as the imputed taxation of professionals, generated an additional 1.8 billion euros.

The Greek government’s economic team is focused on a three-year roadmap leading to record-breaking investment levels in the Greek economy and further tax relief primarily for the middle class.

The particularly favorable circumstances for Greece, driven by a massive investment program funded by the Recovery and Resilience Facility (RRF) and the EU’s Structural Funds, combined with significant revenue increases due to measures against tax evasion, are ideal for closing the country’s investment gap at a faster pace and reducing the tax burden on citizens, according to government officials.

Public Investments

The Public Investment Program that Greece is set to implement over the next three years is the largest in the country’s history, presenting a major challenge. For 2024, it is budgeted at 13.15 billion euros, rising to 14.1 billion euros in 2025 and an estimated 15 billion euros in 2026.

This amounts to a colossal public investment program exceeding 42 billion euros by the end of 2026. It includes funding from the RRF and EU structural funds, supplemented by domestic state financing.

These funds are allocated for projects across all sectors of the economy, including construction, infrastructure, energy, health, education, and digital development in key areas.

Tackling Tax Evasion

In the fight against tax evasion, the digitalization of transactions and measures introduced by the Ministry of Finance, such as the imputed taxation of professionals, generated an additional 1.8 billion euros in revenue for 2024.

The ministry expects this increase to continue in the coming years due to the effectiveness of current measures and the introduction of new interventions, particularly in digital transactions and the technological upgrade of tax audits.

The ministry’s target is to generate an additional 2.5 billion euros annually by 2027 through policies aimed at curbing untaxed revenue, which will pave the way for further tax cuts focused on relieving the middle class.

The government’s determination was recently resonated in Prime Minister Kyriakos Mitsotakis’, speech at an event of the Independent Authority for Public Revenue (AADE), during which plans to reduce tax rates for middle-income wage earners and to lower living cost imputation thresholds to address existing injustices and inefficiencies were announced.

Source: tovima.com

- Συναγερμός για μεγάλη πυρκαγιά σε εργοστάσιο στις Αχαρνές

- Δεκατρία σιδηροδρομικά δυστυχήματα με νεκρούς στην Ισπανία από τις αρχές του αιώνα

- Συρία: Ο επικεφαλής των κουρδικών δυνάμεων επιβεβαιώνει τη συμφωνία εκεχειρίας που ανακοίνωσε ο αλ Σάρα

- Η Γερμανία ζητά απάντηση από την ΕΕ στους νέους δασμούς του Τραμπ και θέτει θέμα για την εμπορική συμφωνία

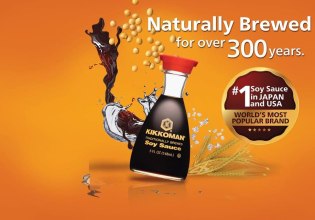

- Ιαπωνία: Η μεγαλύτερη εταιρεία σάλτσας σόγιας αποκτά …γεύση για deals

- Αερομεταφορές: Η κούρσα για την επόμενη γενιά κινητήρων τζετ

- Σοσιεδάδ – Μπαρτσελόνα 2-1: Σοκ για τους Καταλανούς και «φωτιά» στη La Liga! (vid)

- Γροιλανδία: Η ΕΕ σχεδιάζει αντίποινα με δασμούς ύψους 93 δισ. ευρώ στις ΗΠΑ

Ακολουθήστε το in.gr στο Google News και μάθετε πρώτοι όλες τις ειδήσεις

![Άκρως Ζωδιακό: Τα Do’s και Don’ts στα ζώδια σήμερα [Δευτέρα 19.01.2026]](https://www.in.gr/wp-content/uploads/2026/01/lucas-marconnet-Kls_Hq8p-xI-unsplash-315x220.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232442

Αριθμός Πιστοποίησης Μ.Η.Τ.232442